We're here to help you offer the best health benefits for your most valuable assets - your employees.

We have partnered with top carriers to provide comprehensive benefits that will keep your employees happy, healthy and productive, and keep your organization competitive in the quest for top talent.

Offer a high quality 401(k) retirement plan that is seamlessly integrated with your payroll, all through the ScalePEO platform.

Additional benefit programs are just around the corner; we have an abundance of options for you to offer to your employees.

With ScalePEO benefits, everyone wins.

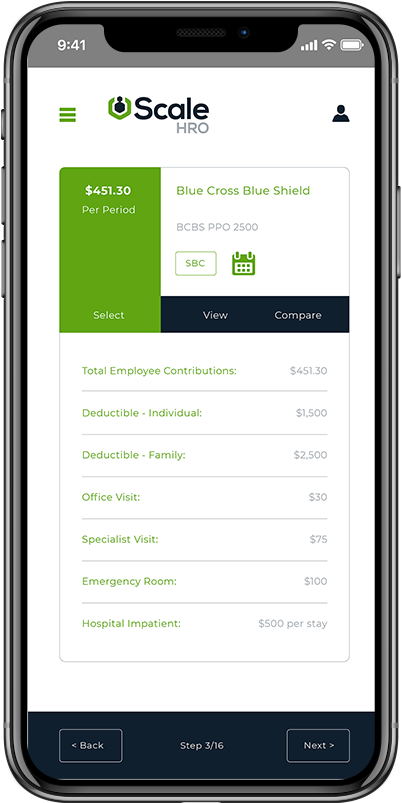

Whether on a desktop or mobile device, selecting, comparing, or changing benefit elections during enrollment is both intuitive and simple.

Managing benefits enrollment can be time-consuming and costly, but with employee notifications and enrollment status tracking, benefits enrollment can be completed in record time.

Offer a benefits package that rivals that of a Fortune 500 company with medical, dental, vision, commuter benefits, Flexible Spending Accounts (FSA), Health Savings Accounts (HSA), Employee Assistance Programs (EAP), and more.

Employees are alerted when required information is missing, whether it's a waiver, birthdate, or Social Security Number. After making each of their elections, employees receive a clear enrollment summary with plan costs.

Whether it’s managing dependents or comparing plan options, your employees will be empowered to understand and more fully take advantage of employer-sponsored and voluntary benefits.

All data is encrypted before being sent to or stored in the cloud, and is actively monitored 24/7/365 to protect against data breaches and cyberattacks.

Yes! We have all the makings of a top-notch employee benefits package. We offer dental, vision, FSA, HSA, dependent care, retirement plans, and more!

Nope, you don’t. We completely understand that your broker is one of you most trusted advisors which is why we are happy to work with them, and they can remain your broker of record.

At ScalePEO our goal is to consolidate and automate all your repetitive, non-revenue adding, employee-related tasks and paperwork so that you can focus on growing your organization, while simultaneously offering an elevated employee experience and benefits package. We are a comprehensive HR solution— meaning we are one team of experts, one vendor— and this cohesion is key to our success. Choosing just one offering defeats the purpose of a single provider solution. Of course, we still understand that companies aren’t one-size-fits-all which is why we offer three distinct HR solutions for you to pick from.

Yep! We can carve out ancillary coverage so that you can continue dental coverage with your current carrier, keep in mind though that you or your broker will continue to also oversee the administration for that piece. Medical coverage, however, cannot be carved out.

Now that 2024 is officially in full swing, we want to help ensure you are set up for success and aware of the most important compliance updates. Below we outline some of the many employment changes that took effect in 2024. Please note that this is not an all-encompassing list. ↠ Contact us to learn how the collective purchasing power of our PEO can help you obtain the large group style benefits you've always wanted.

Wondering how to save your company during a recession? You're not alone. A recession spells doom and gloom for many businesses. Lowered sales, shriveling income, and decreasing disposable income characterize a recession, crippling many businesses.

Small- and medium-sized businesses continue to face Human Resource challenges mainly due to the changing employment laws and increased employee expectations. To overcome these challenges, SMBs are turning to Professional Employment Organizations (PEOs) to help them find talent.

We take on the burden of HR and administrative tasks allowing you to focus on increasing productivity and growth.

Doing business in California as SPG Insurance Solutions License No. 0L09546