Definition: PEO | Professional Employer Organization

A professional employer organization, or "PEO," partners with small to medium-sized employers to provide comprehensive outsourcing of various employee management and administrative tasks including payroll, HR, benefits, compliance, and risk management.

If you have been looking to outsource HR, payroll, benefits, and risk management, then you are in the right place. We will help you understand what a PEO is, how it helps grow your business, increase your buying power, and enhance your efficiency so you have more time to focus on the big picture! Get started now!

Here's how:

Using a co-employment model, the client company (employer) and the PEO enter into a Client Service Agreement (CSA). The CSA outlines the relationship and delineates the responsibilities between the PEO, the client company, and the client company’s employees also known as "worksite employees."

Under this agreement the PEO becomes the employer of record for the worksite employees and takes on employee management and non-revenue generating tasks like:

- processing payroll, and withholding and paying associated taxes

- HR administration, support, and training

- employee benefit plan sponsorship and administration

- regulatory paperwork, and compliance and risk management

- Workers' Compensation insurance and administration

All the while, the employer retains 100% control of business decisions and continues to supervise the business' day-to-day operations as well as the employees' daily activities.

Deciding when to use a PEO

The road to working with a PEO is different for every business. However, there are often common themes behind why companies seek help from a PEO.

Imagine this: your revenue streams are stable, you are managing the workload well enough-- overall, things are going pretty smoothly-- right up until they aren't.

Suddenly, a new pain-point pops out of nowhere, or a new government regulation goes into effect, or you lose a highly valued employee to a competitor, maybe a payroll deadline is missed, or perhaps a discrimination lawsuit notice arrives... whatever the issue, something has gone wrong.

While their forms vary, the inevitability of challenges arriving outside the core of your business remains. It's often these challenges that lead employers to look for new solutions and support.

Of course, your ability to find that trusted person or group to support you requires that you first be honest in self-reflection.

So now is the time to ask, as a business owner focused on growth, is HR our strength?

.png?width=900&name=What%20is%20a%20PEO%20Pillar%20Page%20AssetsIdeas%20(1).png)

Are you asking the right people for help? Are you stuck in a rut and telling yourself, “We’ve always done it this way, and it seems to work”?

If so, it's likely that the following terms may sound familiar as unmet goals:

- Increase Profitability

- Enhance Efficiency

- Reduce Time Doing Transactional HR

- Reduce Liability

- Increase Buying Power

If any of the above rings true, then it is time to explore enlisting the help of a PEO. Once you get past the acronyms and definitions, the heart of partnering with a PEO means establishing a relationship with a company that offers the credentials, experience, and expertise to diagnose your HR problems and manage the process that leads to their solutions.

An effective PEO crafts a solution using a multidisciplinary approach which manages the complexities of being an employer. A PEO collaborates with you to allow your leaders more time to focus on the business. Using all of their areas of expertise, a PEO also builds the infrastructure required to manage any business from a human resource context. It also helps you bolster legal compliance and access and administer high caliber employee benefits.

In fact, employee benefits are one of the more complicated parts of the owning a business. This is why most companies work with an insurance broker.

.png?width=900&name=What%20is%20a%20PEO%20Pillar%20Page%20AssetsIdeas%20(2).png)

Brokers help companies navigate the complex world of group health plans, 401(k), the Affordable Care Act (ACA), COBRA, and more. Many business owners consider their broker one of their most valued consultants, leaning on them for support not only during open enrollment but also throughout the entire year.

But what happens when these same business owners need help with payroll, HR, and workers’ compensation or risk management? Who helps with that? A PEO, that’s who.

You’re thinking “Great! Problem solved! That sounds easy enough.” Well, not always.

The Insurance Broker and PEO Relationship

When it comes to working with brokers, not all PEOs are created equal.

Too often overwhelmed business owners are elated to discover PEOs only to then realize that they will have to sever their relationship with their trusted insurance broker. This is because, despite the important role brokers play for many businesses, some PEOs work exclusively with the client, cutting the broker out entirely.

Fortunately, when you find a broker-friendly PEO like Scale, this doesn’t have to be the case. More on this below.

What Does an Insurance Broker Do?

Let's quickly review the important role of an insurance broker. Insurance brokers are licensed professionals that help their clients find the right products and coverage for their particular needs. A good broker works with you to understand your background and goals and typically helps with things like:

- Identifying your risks, and coverage(s) needed to help you build out a well-rounded employee benefits package that attracts top talent.

- Shopping the market on your behalf to obtain quotes from various carriers in order to compare prices, plans and coverage and then explain the options to you.

- Assisting you with getting claims, billing, enrollment, and customer service issues resolved.

- Staying up-to-date on the ACA and various insurance regulations and providing ongoing guidance and best practices.

Despite the fact that PEOs and brokers can work together to provide a truly comprehensive solution for businesses, the relationship between the two entities has traditionally been tense.

This is because PEOs often market directly to clients, offering them benefits and workers’ comp options, amongst other things. Brokers then feel threatened by the PEOs who are approaching their clients and prospects with robust packages, threatening to take away their business.

ScalePEO was actually founded by brokers. Because of this firsthand experience we understand the unique value a broker brings to the situation-- important insights, solid relationships, meaningful history-- and these are all key pieces of the puzzle. This is why we NEVER cut our clients’ brokers out of the equation. Following are just some of the ways that we work through an onboarding process with brokers:

- Your broker can remain the Broker of Record

- Scale clients work with their broker to select the best benefits package

- Brokers are invited to the Client Kickoff Call with the Scale Implementation Team

- Brokers can easily access and obtain information and up-to-date censuses through the online portal

- The Scale Client Care Team provides broker friendly support

Being a business owner is difficult, period….

Benefits, payroll, tax management, HR, compliance, hiring, and so much more make it hard to stay focused. If your current broker relationship is one thing that helps you stay on track, but you are still looking for PEO options, then ScalePEO is for you.

Common challenges and how working with a PEO helps

To help you understand the specific ways a PEO can bring value to your organization we have outlined some common scenarios below.

You are hiring like crazy and need end-to-end support. ScalePEO can help with applicant tracking, interview prep and best practices, streamline your new employee orientation, and provide a user-friendly and 100% electronic onboarding process via your own customized online portal.

An employee moves out of state but stays on in a remote capacity. ScalePEO will update you on the employment and HR laws for the new state to help ensure that you, and your employee, don't miss a beat.

Your HR Manager is stretched thin and doesn't have time for big initiatives. In today's competitive job market, even the smallest companies can't afford to ignore things like company culture, employee retention, wellness, and inclusivity. ScalePEO's vast digital content suite gives your HR team instant access to templates and tools they need to quickly and easily create custom employee handbooks, forms, job descriptions, and more.

Payroll is a giant headache. The ScalePEO team is no stranger to the payroll and tax game. Our experts file your payroll taxes, W2s and 1099s, and stay up-to-date on the latest regulations. In addition, our time and labor system is integrated with payroll which means data flows seamlessly between payroll, benefits, and HR thereby eliminating the need for manual processing and data entry, and saving your team valuable time.

You need workers' compensation coverage but the upfront costs are so expensive! ScalePEO has a "pay as you go" program, which means your premium is based on your actual payroll and not on the projected annual payroll. Because your payments are based on real-time payroll wages, there is no audit at the end of the policy. Finally, by spacing your workers' comp insurance costs out throughout the year (instead of one large upfront payment) you can better manage your costs.

-1.png?width=900&name=Copy%20of%20What%20is%20a%20PEO%20Pillar%20Page%20AssetsIdeas%20(2)-1.png)

- retirement 401(k) plans

- health, dental, life

- AD&D, dependent care

- Employee Assistance Program (EAP), telemedicine, commuter benefits, and more.

Why use a PEO?

Why use a PEO?

Running your business is hard.

You have enough on your plate as it is-- even without the added burden of payroll, benefits, HR administration, and compliance.

.png?width=600&name=Copy%20of%20Copy%20of%20What%20is%20a%20PEO%20Pillar%20Page%20AssetsIdeas%20(8).png)

1. Greater Overall Business Outcomes

According to NAPEO, small businesses that work with a PEO:

grow 7 to 9 percent faster

have employee turnover that is 10 to 14 percent lower

are 50 percent less likely to go out of business

.png?width=900&height=900&name=Copy%20of%20What%20is%20a%20PEO%20Pillar%20Page%20AssetsIdeas%20(9).png)

2. Increased Buying Power & Richer Benefit Offerings

PEOs enable a group of small businesses to essentially band together and get the buying power of a much larger group. This increased purchasing power leads to more comprehensive benefit offerings that rival big-company benefit packages.

3. Expert HR Support and Training

PEOs stay current on the latest federal and state government employment regulations, including ACA compliance, benefit administration, payroll, and tax management. Client companies gain confident peace of mind knowing their business is compliant and shielded from litigation.

4. Enhanced Efficiency

PEO clients get time and space back in the day to work on their company goals and redirect focus to their core competencies.

ScalePEO in Action

Create a solid foundation from Day 1

Helping companies onboard new hires to the team is just one example of how Scale helps clients streamline processes, improve communication, and increase employee satisfaction.

Think about the process and approach you take towards new hires. Those key first days on the job affect cultural alignment, employee happiness, retention, and overall output. And yet, despite the importance of these first days, it's common to miss a step. There are numerous forms to complete, notices to read through, processes to explain, and more.

Knowing how important it is to not miss any steps we developed an interactive "New Employee Orientation Checklist." Our HR experts have developed, tested and refined this robust checklist which provides helpful tips such as:

Forms to be completed by Employee:

- Form W-4 tip: make sure to share this info with your payroll representative.

- Form I-9 tip: once the employee has completed section one, you or a designated company representative will be required to complete section two. Retain the completed I-9 in a separate I-9 file or binder.

- State Withholding Form (if applicable) tip: make sure to share this info with your payroll representative.

Notices to be provided to Employee:

- CHIP Notice

- Notice of Exchange and Subsidies Tip: There are two versions, one for employers who offer health insurance, and one for employer who do not. Be sure to use the appropriate version.

To download the entire list of forms, click the image "New Employee Orientation Checklist."

Stress-free payroll

Payroll is an essential aspect of any business, but when you’re laser-focused on building your business payroll management becomes yet another “to-do” in an already hectic schedule. On top of this, misconceptions about payroll pose some of the biggest, most costly risks to a business owner.

Below are five outdated or misleading statements we hear about payroll again and again. Have you fallen victim to any of these falsehoods? If so, don’t worry, we can help you get your payroll on track and done right each and every time.

Myth #1: "Salary employees are always exempt from overtime rules."

Myth #2: "Only large companies need to outsource their payroll."

Myth #3: "We have a lot of experience doing payroll so we aren’t worried about compliance issues."

Myth #4: "It’s cheaper to do payroll in-house."

Myth #5: "Moving payroll is a nightmare."

We understand that change is scary, and that change involving payroll is particularly daunting. Luckily, PEOs and payroll providers know this. So, if you're worried about the move, communicate your fears. A good provider should give you clear information on what the process will be like and who you can turn to for help.

Bottom line, stay focused on the long-tail benefits of payroll administration via a PEO: streamlined functionality with cloud computing and automation, increased compliance and accuracy, cost savings, and comprehensive reporting.

.png?width=900&name=Copy%20of%20Copy%20of%20What%20is%20a%20PEO%20Pillar%20Page%20AssetsIdeas%20(9).png)

A proven implementation process.

Curious how we ensure a smooth transition to Scale? Then let's dig into the team and people that make it all happen.

At ScalePEO we understand the impact that moving payroll and health benefits can have not just on the employer, but also on employees and their families. We also understand that a good and thorough implementation is critical to long-term success. This is why we have developed a well-defined process by which to onboard all new clients.

At the start of every partnership, each ScalePEO client is assigned a Dedicated Implementation Specialist. This specialist takes them through the initial sales process and gets them set up in the system. Examples of the quality control checks and implementation and onboarding support that takes place during this time include:

- Client works with their broker and/or the Scale team to select the best-fit benefits package and sign the proposal

- A Kickoff Call is completed with the Client and the Scale Implementation Team

- Recurring meetings are scheduled with the dedicated Scale representative

- Live system and technology training is completed

- Implementation Experience Survey is distributed to client for completion

"We did back-to-back conversions and converting to Scale was a much smoother process than the first. The support was phenomenal, and the accuracy was on point. I like that I can get them on the phone immediately if I so choose.” -- ScalePEO Client

Once implementation is complete, our clients stay in touch with their Implementation and Onboarding Specialist. Yep, you read that right: we don't disappear, never to be seen or heard from again. We remain as accessible as before.

What about quick questions like how to run a report or use a dashboard? For general questions, all Scale clients also have access to the Client Care Team. This team works as an additional resource for how-to questions, system support, and more.

We believe that the thoroughness of the implementation process directly affects the overall success of the Scale-Client relationship. Clear communication, thorough training, easy access to resources, and client feedback are the keystones of our successes and also the successes of our clients.

You now have a solid idea of not just what a PEO is, but also how it works and some of the top reasons why a company chooses to join a PEO. However, you may be thinking, "But what about me? How will my specific situation benefit from a PEO arrangement?" We hear you! Continue reading below to learn more.

Benefits for your business

Benefits for your business

Now you're wondering, "But will this help my company?"

In a word, Yes!

-1.png?width=900&name=What%20is%20a%20PEO%20Pillar%20Page%20AssetsIdeas%20(1)-1.png)

This is because PEOs allow the people in your organization to shine, using the skillsets they were hired for, to do the work your business was created to do.

In this section you will learn about differences between a PEO and online HR software, the pros and cons of a PEO, the top payroll issues many companies face, and how PEOs help businesses navigate complicated employer regulations and federal programs the PPP program. Let's get started.

One option that can help is HR software, sometimes referred to as an online HR platform. While both PEOs and HR software can be valuable resources to employers, there are notable differences between them. Here we break these differences down and explain the unique value each model has to offer.

Differences between a PEO and online software

First, let's review what a Human Resources Information Systems (HRIS) is and what it does.

HRIS

An HRIS is an online platform or software that helps streamline HR administration giving the HR team a set of tools and a platform by which to manage their HR functions. The tool can help organize and manage HR tasks such as:

- applicant tracking

- hiring

- onboarding/offboarding

- benefits enrollment

- time management

.png?width=900&name=Copy%20of%20Copy%20of%20What%20is%20a%20PEO%20Pillar%20Page%20AssetsIdeas%20(1).png)

PEOs

While PEOs typically offer an online platform or HRIS, their services extend beyond this technology to include:

- payroll and HR administration

- access to benefits

- benefits administration

- compliance and risk management

Additionally, the PEO acts as one comprehensive solution, versus having to outsource payroll, HR, benefits administration, and workers’ comp to several different vendors and platforms.

Key Takeaway in HRIS vs. PEOs

PEOs and HRIS both offer tools to help you administer benefits, HR, payroll and more.

The main difference is that HRIS is a tool in the form of an online software, whereas, a PEO goes beyond the HRIS to include a more holistic solution.

With a PEO, you not only receive the technology of an HRIS but you also get the support of a team of certified experts that guide you along the way and help you develop processes and strategies that are the best fit for your specific business.

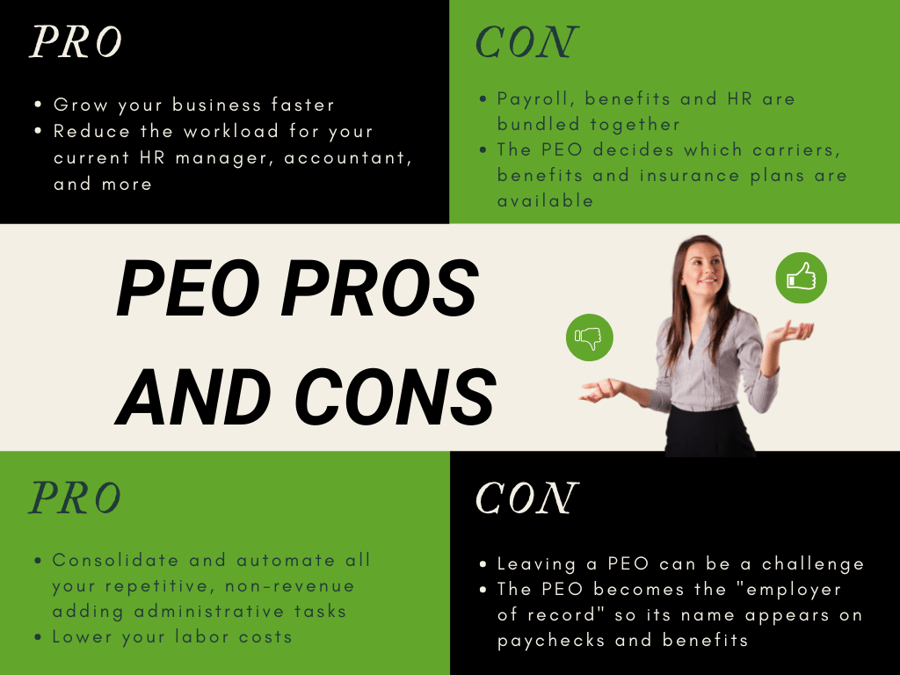

Pros and Cons

To help you understand a bit more about the pros and cons of utilizing a PEO, we've listed a few key points below.

Pros:

- Your repetitive, non-revenue adding, HR related tasks and paperwork are consolidated and automated so you can focus on your company goals.

- Grow your business faster. According to NAPEO businesses that use PEOs grow seven to nine percent faster than those that don’t.

- Lower your labor costs. Per NAPEO, the administrative cost for businesses that use a PEO is around $450 less per employee when compared to companies that don’t use PEOs.

- Increase your buying power. The collective purchasing power of a PEO enables smaller businesses to offer competitive and comprehensive benefits that attract top talent.

- Lessen your paperwork and increase your productivity. By reducing the workload for your current HR Manager they can focus on bigger initiatives like employee retention and company culture.

- Support and training from experts in HR and risk management. Up-to-the-minute law alerts, trainings, employee handbook tools, and more help shield your business from litigation.

- Better budgeting and forecasting with payroll management reports and all-in-one HRIS.

Cons:

- As the employer of record, the PEO's name-- not the client company's name-- will appear on all employees’ paychecks and benefit documents.

- All services ScalePEO services are bundled together which means you cannot pick which solutions to sign up for. While you can pick the HR package that best suits your needs you cannot elect to sign up for benefits and HR but skip payroll.

- Leaving a PEO can be a challenge as you have to replace services that were previously bundled under one PEO and replace them all with various vendors and platforms.

- The PEO decides which insurance carriers, benefits, and insurance plans are available under the PEO.

If your main goal is simply to streamline HR administration then an HRIS may be sufficient.

However, if your goal is to increase your benefits buying power, offer more competitive benefits, reduce your overall liability, gain HR expertise, payroll support, and reduce administrative burdens, then a PEO is a better fit.

Full service payroll made easy.

Perhaps nowhere else in your business are accuracy and timeliness of more paramount importance than in payroll. Despite this fact, mistakes happen and the price employers pay for these mistakes can be costly. Ramifications for an incorrect payroll can include paying back wages and taxes and/or hefty fines and penalties, and, in extreme cases, even prison time. Not to mention the immeasurable hit to employee morale when payroll is processed incorrectly.

Following are five of the top payroll mistakes companies make. We put them into one list, so you can learn to spot these issues before they become a larger problem. Read on.

#1 Paying the wrong amount for taxes

Paying the wrong amount in payroll taxes is frequently due to simple errors on tax forms. Entering an incorrect total or putting an amount on the wrong line can lead to a snowball effect which complicates reconciling W2s with year-end tax returns.

In addition, tax rates can change. If you don’t stay on top of these changes then errors happen, causing you to owe additional money.

#2 Running payroll late

Sometimes payroll isn’t completed on time. Not only is this a complete morale crusher for your employees that can seriously impact on both their and their families lives, but it can also come with penalties and fines for you.

Employers can also get into hot water by failing to issue a departing employee’s final check on time. Many states require final paychecks to be issued very quickly, sometimes even on the same day that an employee leaves.

.png?width=900&name=no%20room%20for%20error%20(1).png)

#3 Using incorrect and/or outdated employee info

When payroll and HR systems aren't integrated employers are left to manually enter or transfer data like wages, time, and account numbers from one system to another. And with more manual data entry comes more chance for errors. What's more, incorrect employee addresses, name changes, or outdated hourly rates can also cause problems with the IRS.

#4 Miscalculating overtime

Calculating overtime can quickly, and easily, get pretty confusing.

Per the Fair Labor Standards Act (FLSA) covered nonexempt employees must receive overtime pay at a rate not less than one and one-half times the regular rate of pay for hours worked over 40 per workweek. In addition, employers must also follow any state or local overtime laws. For example, in states like California there are rules for daily and seventh consecutive day overtime, as well as rules on double time.

#5 Classifying Employees VS Independent Contractors

Are your new remote workers full-time employees, contractors, or some mix of the two? Incorrectly classifying your employees can lead to a whole slew of issues to deal with.

By selecting a system that integrates time and labor tracking with payroll and HR you eliminate the need for time-consuming manual data entry and decrease keying errors. PEOs also stay up-to-date on employment regulations and can provide the resources employers need to stay compliant.

The following information is an example of the type of insight and support the ScalePEO team was able to provide to our PEO employer clients in regard to COVID-19 related legislation. Please note that the Paycheck Protection Program (PPP) ended on May 31, 2021. For more information on COVID-19 programs please check with the U.S. Small Business Administration (SBA), Department of Labor (DOL), Internal Revenue Service (IRS), U.S. Department of the Treasury, or consult with your tax or legal professionals for additional information.

The Coronavirus Aid, Relief, and Economic Security Act, also known as the “CARES Act,” was signed into legislation in Spring of 2020.

The CARES Act consisted of three programs:

- The Small Business Administration Paycheck Protection Loan Program

- The 50% Employee Retention Tax Credit

- The Social Security Tax Deferral

These programs were designed to help employers keep their employees on the payroll during the COVID-19 crisis.

Given its complexity, we decided to provide some clear-cut answers to help business owners understand one of the more popular options of the CARES Act: the Paycheck Protection Loan Program (PPP).

Following are some frequently asked questions supplied by NAPEO. NAPEO is “The Voice of the PEO Industry” and acts as an advocate on behalf of the entire PEO industry, provides important education, and member resources.

Q: I have heard that only businesses with fewer than 500 employees (outside of limited exceptions) can qualify for a PPP loan. My professional employer organization (PEO) provides services for over 500 co-employees. Does that mean I can't qualify for a PPP loan?

A: Fear not: your PEO's co-employees will not be counted against you for PPP loan purposes unless your business are otherwise related (such as with common ownership).

This question was raised and resolved as far back as 1989, when the Small Business Administration's Office of Hearings and Appeals reversed a regional office's determination that the PEO's total number of co-employees must be counted against the small-business client.

Based in part on this ruling, 13 CFR § 121.103(b)(4) of the SBA's affiliation regulations were amended to codify the same result:

"Business concerns which lease employees from concerns primarily engaged in leasing employees to other businesses or which enter into a co-employer arrangement with a professional employer organization (PEO) are not affiliated with the leasing company or PEO solely on the basis of a leasing agreement."

Of course, if your company and the PEO are related in other ways that would trigger the SBA's affiliation rules (such as with common ownership), then the result may not be the same. However, for the majority of PEO clients, the PEO's co-employees should not be included in your business's employee count for PPP loan purposes.

Q: My PPP lender is asking for my Forms 941 for purposes of determining my eligibility for, and the amount of, a PPP loan. Because I use a professional employer organization (PEO), I don’t file my own Form 941. What should I tell them?

A: Don’t be worried. It’s not surprising that the lender may be asking for Forms 941 for purposes of underwriting the PPP loan. Thankfully, the SBA does not require lenders to use any tax information, such as a Form 941, for purposes of underwriting your loan.

The SBA makes clear in its interim final rule (SBA IFR) that lenders are not limited in the types of documentation they can use to determine your eligibility for a PPP loan, and the amount of such loan. Specifically, the SBA IFR provides as follows:

"Borrowers must submit such documentation as is necessary to establish eligibility such as payroll processor records, payroll tax filings, or Form 1099-MISC, or income and expenses from a sole proprietorship. For borrowers that do not have any such documentation, the borrower must provide other supporting documentation, such as bank records, sufficient to demonstrate the qualifying payroll amount. (SBA IFR section 3.b.(iv).II.)

It might be helpful if you provide this language to the lender and request that the lender utilize other documentation (such as payroll records) to confirm your eligibility for a PPP loan.

Q: Looking at the SBA's website, I see that I can apply for an Economic Injury Disaster Loan (EIDL). Is that the same as a PPP loan? If I've already received an EIDL loan, does that mean that I can't receive a PPP loan?

A: It can certainly get confusing with all of the new terms and acronyms flying around. While both loans are authorized by Section 7(a) of the Small Business Act (as amended by the CARES Act) and are meant to help businesses hurt by the COVID-19 pandemic, an EIDL is not the same as a PPP loan in many key areas.

For example, their purposes are different. PPP loans are primarily meant to help businesses with "payroll costs," which includes certain wages, benefits, and state and local taxes, as well as to help with payments on mortgage interest, rent, utilities, and interest on pre-existing loans. EIDLs, on the other hand, are meant to provide working capital and can be used to pay fixed debts, accounts payable, and other similar bills, as well as the items covered under PPP loans.

Their covered periods and loan caps are different. COVID-19 EIDLs are available for economic injuries that occurred between January 31, 2020 and December 31, 2020 and are capped at $2,000,000, while PPP loans only cover costs incurred from February 15, 2020 through June 30, 2020 and are capped at the lesser of 2.5 times the average monthly total of "payroll costs" or $10,000,000.

However, the biggest difference between the two is that, under certain conditions, some (or all) of the PPP loan is forgivable while EIDLs are not forgivable (although eligible applicants for an EIDL can receive a $10,000 emergency grant within three days of application). The amount of a PPP loan that is forgivable may not be comprised of more than 25% of non-payroll (but otherwise qualifying) costs. Such costs would include certain qualifying payments for rent, utilities, and mortgage interest. And the amount that is eligible for forgiveness is generally reduced if the employer reduces headcount or reduces an employee’s total salary or wages. EIDLs have no such provisions for forgiveness.

So, what happens if you need a PPP loan but have already received an EIDL? If you received an EIDL loan between January 31, 2020 and April 3, 2020, you can still apply for and receive a PPP loan. To prevent “double dipping,” EIDL funds cannot be used for "payroll costs" or other PPP allowable uses if you want to qualify for both. However, even if you used some of the EIDL's funds for PPP purposes, you may still be able to "refinance" those amounts into the PPP loan during the application process and then be able to seek forgiveness on certain of the PPP loan proceeds (because the qualifying costs incurred during the life of the EIDL would now relate to a PPP loan versus an EIDL).

Deciding which CARES Act program is right for your business is a complicated, and extremely important choice to make. We hope that these FAQs from NAPEO have provided some clarity on which path is best for your situation. Remember, the goal here is to give you clear information to enable you to make the best decision as you move forward.

At ScalePEO, we love to help companies offload tedious processes, and complicated paperwork so they can get back to what really matters-- serving their customers and community! Continue reading, and get all of the resources you need to help you select a PEO. Or if you are ready to speak with a member of the Scale team then reach out now.

-1.png?width=900&name=Copy%20of%20What%20is%20a%20PEO%20Pillar%20Page%20AssetsIdeas%20(1)-1.png)

.png?width=900&name=Green%20and%20White%20Clean%20and%20Simple%20Business%20Progress%20Report%20Sustainable%20Development%20Goals%20Presentation%20(2).png)

.png)

.png?width=250&name=Copy%20of%20What%20is%20a%20PEO%20Pillar%20Page%20AssetsIdeas%20(11).png)

.png?width=900&name=featured%20image%20for%20social%207%20signs%20infographic%20(5).png)

.png?width=900&name=Copy%20of%20Copy%20of%20What%20is%20a%20PEO%20Pillar%20Page%20AssetsIdeas%20(14).png)

.png?width=900&name=Copy%20of%20Copy%20of%20What%20is%20a%20PEO%20Pillar%20Page%20AssetsIdeas%20(15).png)